Blockchain & Bitcoin introduction 23 Jun 2016

The Blockchain (block-chain)

This article is intended to be an introduction to the blockchain technology that was introduced with the Bitcoin currency. Some details I believe are not important will be deliberately omitted to ease the understanding of this article. I will try to keep a technological approach rather than a financial/ethical one. You will not find any discussion about how to buy/ manage Bitcoins or my personal opinion on whether you should invest in that currency.

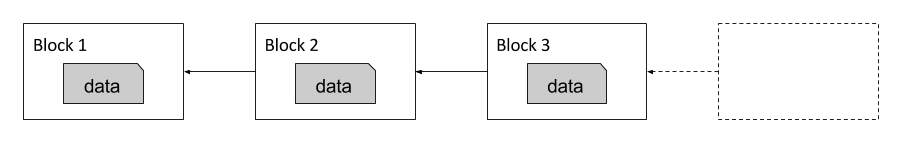

Is a database

A blockchain is a way to store data. It can be compared to a new type of database. It is composed of blocks that are chained together thus forming a block-chain. Each block is linked to the previous block of the chain. A block contains data or even programs in some recent implementations.

The blockchain was the technological innovation behind the first decentralized digital currency, the Bitcoin. Nevertheless other types of blockchains have been created since which are not targeted to be digital currencies. The real revolution of the blockchain is the promise of reducing the cost of establishing and maintaining trust for both individuals and organizations. This trust is enforced by various mechanisms that we will detail below.

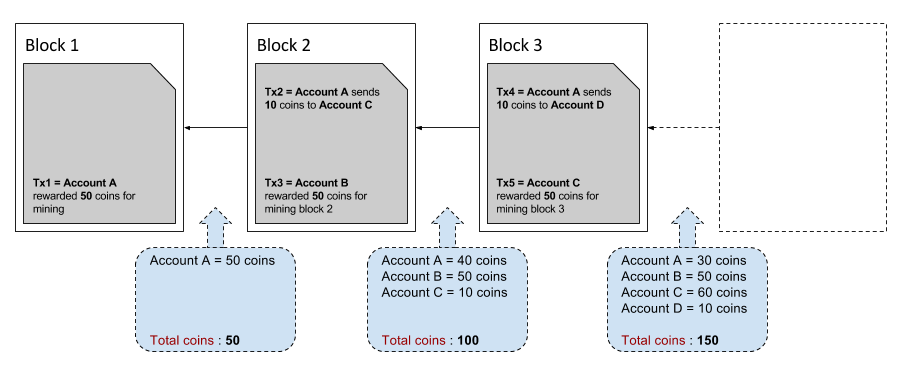

In the following paragraph we will use the Bitcoin as an example of blockchain. For the Bitcoin, each block contains a list of transactions like this

Account A sent 10 coins to Account B

Account C sent 5 coins to Accound D

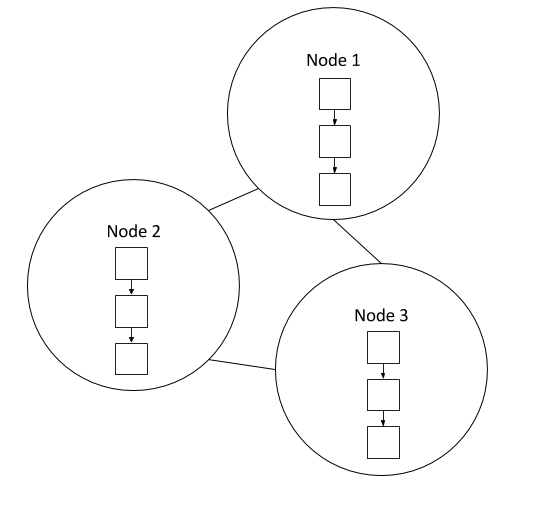

Is distributed

We need to remember that the blockchain, which was introduced with the Bitcoin currency, had one objective :

A purely peer-to-peer version of electronic cash [which] would allow online payments to be sent directly from one party to another without going through a financial institution.

Basically the goal is to remove the trusted third party needed in electronic transactions. One of the problem with trusted third parties is that they represent a single point of failure. Thus the Bitcoin blockchain was designed to be distributed. In fact, each node composing the Bitcoin network contains a copy of the entire blockchain. Because each block contains a list of transactions, the Bitcoin blockchain is also referred as a public ledger. No central party has ownership of the ledger, therefore no one can individually amend the entries already on the blockchain.

When new transactions arrives they need to be verified, meaning if an account A has a balance of +10 coins, the owner of account A should not be able to spend more than those 10 coins. This problem is also known as the double-spending problem, where one could use one digital token/coin twice. This problem cannot happen in real life, with real coins, unless you are a good magician. This verification is also distributed. It is not the responsibility of someone in particular to verify the transactions. Instead, all nodes validate the transaction independently. This is possible because the blockchain is known by everyone and because transactions are not encrypted, so anyone can go back in the past and re-compute the balance of an account.

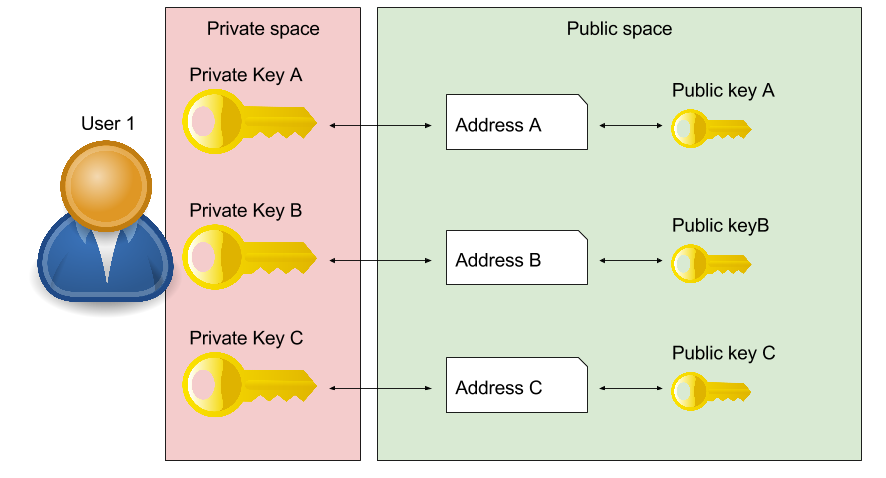

Uses address pseudonyms and digital signatures

Distributing the blockchain would not be enough to make the system safe. Users making transactions should stay anonymous. A user may not want anyone to know that he has concluded a transaction with some other user. This is also why users (= account) are referenced as an address. An address is an identifier of 26-35 alphanumeric characters. Unlike e-mail addresses, people have many different Bitcoin addresses and a unique address should be used for each transaction. To simplify you can see an address as a pseudonym. If your pseudonym is being linked to your real identity and you always use the same pseudonym for each transaction then all your transactions will be known, because the entire blockchain is accessible to anyone.

Here is an example of an address.

1BvBMSEYstWetqTFn5Au4m4GFg7xJaNVN2

Also someone should not be able to steal your identity and use your Bitcoins to buy something. That is why each transaction must be digitally signed. The owner of a Bitcoin address has the private key associated with the address. To spend Bitcoins, he must sign his transaction with his private key, which proves he is the owner. The public key associated with each Bitcoin address is public, so anyone can verify the digital signature of the transaction.

Relies on miners

Transactions are stored inside blocks. But blocks are not free to create and require a proof-of-work. A proof-of-work (POW) system (or protocol, or function) is an economic measure originally designed to deter denial of service attacks and other service abuses such as spam on a network by requiring some work from the service requester, usually meaning processing time by a computer. Bitcoin uses the Hashcash proof of work system.

The good analogy here is to compare a block to a gold nugget. Finding one requires a lot of efforts thus one should be rewarded for finding it. Once found, the new gold nugget is added to the total amount of gold in circulation. That is why people “finding” blocks are called miners. Note that the Bitcoin block mining reward halves every 210,000 blocks. The coin reward will decrease from 25 (16.000 us dollar) to 12.5 coins around the 9th of July 2016.

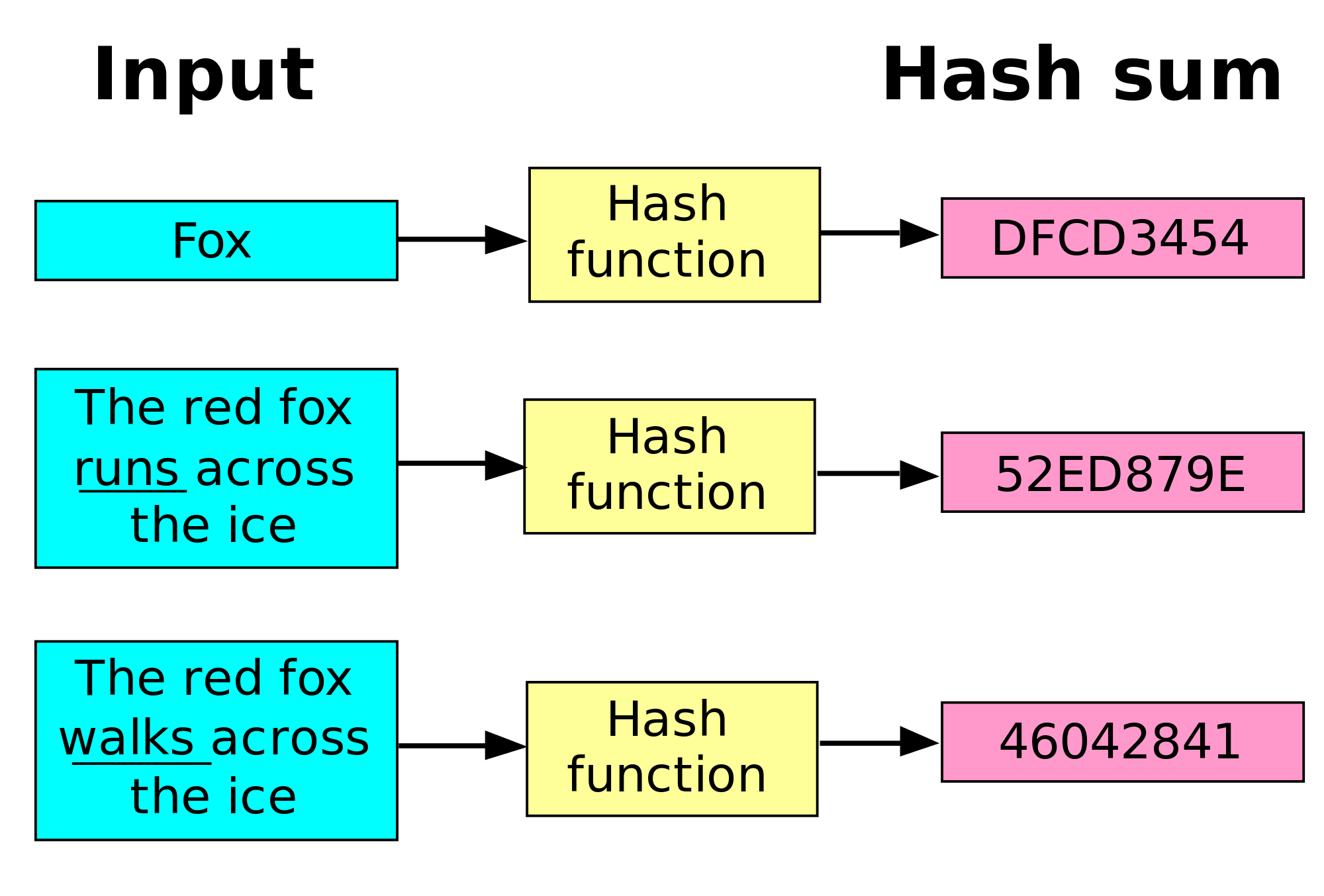

A hash is a function that takes an input (usually a string) and return a number. For a block to be valid, it must hash its content (the list of transactions) to a value less than a certain number called the target.

The target is a 256-bit number (extremely large) that all Bitcoin clients share. The SHA-256 hash of a block’s header must be lower than or equal to the current target for the block to be accepted by the network. The lower the target, the more difficult it is to generate a block. Each block contains the hash of the preceding block, thus each block has a chain of blocks that together contain a large amount of work. Changing a block (which can only be done by making a new block containing the same predecessor) requires regenerating all successors and redoing the work they contain. This protects the block chain from tampering.

Who are hard workers

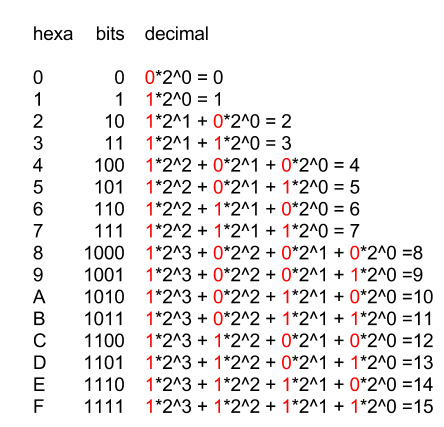

Hexadecimal is a numeral system with a base of 16. Each hexadecimal digit represents four binary digits (bits).

As mentioned before the target hash is a number of 256 bits (= 64 hexadecimal characters). Example

(0x) e3b0c44298fc1c149afbf4c8996fb92427ae41e4649b934ca495991b7852b855

Let’s define the following variables

Content of the block = b

SHA-256 function = h()

Target = t

So finding a block means

h(b) < t

Pb is h() (and all hash functions) is deterministic, meaning

b1 = b2 => h(b1) = h(b2)

It means that if the content of the block does not change, the SHA-256 hash of that content will stay the same. That is why each block contains a nonce field (= number used once = random number). So the real challenge is to find this random number so that h(b) < t. And this is a real lottery, because even a slight change in the nonce number will completely change the value of the hash.

Because hash functions are uniforms, every hash value in the output range should be generated with roughly the same probability. So the probability of finding a valid number equals the number of valid numbers (t) divided by the number of possible output 2^256

t / 2^256

So in average one will need 2^256 / t attempts to find a solution. The lower the target, the higher the number of attempts. This number can be huge!

If you go deeper into that subject you will see that for the Bitcoin, the target number is in fact defined by the number of its leading 0. You will also discover that people are using the notion of difficulty instead of target where difficulty_1_target was the first target defined by the Bitcoin inventor.

difficulty = difficulty_1_target / current_target

Lastly, the bitcoin network, for reasons of stability and low latency in transactions, will adjust dynamically the difficulty so that a block is found in average every 10 minutes. This enables transactions on the network to be validated in an acceptable delay. The adjustment mechanism is based on the time taken to compute the previous 2016 blocks. In the long run, the tendency is to raising the difficulty in order to compensate the increase of computation power of mining pools.

Is not completly secured !

The distribution has its drawbacks. The most famous is called the 51% attack. If one organization or one country was able to gain control of more than 51% of the network nodes then it will be in position to

- prevent transactions of their choosing from gaining any confirmations, thus making them invalid, potentially preventing people from sending Bitcoins between addresses

- reverse transactions they send during the time they are in control (allowing double spending)

- prevent other miners from finding any blocks for a short period of time

But it could not

- Reverse other people’s transactions

- Prevent transactions from being sent at all (they’ll show as 0/unconfirmed)

- Change the number of coins generated per block

- Create coins out of thin air

- Send coins that never belonged to him

Since this attack doesn’t permit all that much power over the network, it is expected that no one will attempt it. A profit-seeking person will always gain more by just following the rules, and even someone trying to destroy the system will probably find other attacks more attractive. However, if this attack is successfully executed, it will be difficult or impossible to “untangle” the mess created, any changes the attacker makes might become permanent.

Summary

The steps to run the network are as follows:

- New transactions are broadcast to all nodes.

- Each node collects new transactions into a block.

- Each node works on finding a difficult proof-of-work for its block.

- When a node finds a proof-of-work, it broadcasts the block to all nodes.

- Nodes accept the block only if all transactions in it are valid and not already spent.

- Nodes express their acceptance of the block by working on creating the next block in the chain, using the hash of the accepted block as the previous hash.